Rockwall, TX (February 16, 2026) – Sometimes the hardest calls come after everything has already changed.

Recently, I heard from a woman who had just lost a close friend unexpectedly. She was the one who called 911. In the days that followed, the grief was compounded by logistics no one had prepared for. Her friend’s husband is seventy-four and living with dementia. They have no children, and sister lives out of state. Fortunately, the woman and a small group of friends stepped in immediately to help with groceries, bills, burial arrangements, cooking, and paperwork.

They did what people do in the beginning. They showed up.

But very quickly, a hard question surfaced. How does this work long term?

The widower has Medicare, his income is limited and he needs more than medical care. He needs daily support, supervision, and help navigating ordinary life; and the people helping him already know what they are doing cannot continue forever.

This is the moment many families and friends find themselves in, not during open enrollment and not during planned retirement, but in the middle of grief, urgency, and uncertainty.

One of the most common misconceptions about Medicare is that it covers long term care. It does not.

Medicare is designed to cover medical needs, doctor visits, hospital stays, skilled nursing care after a qualifying hospital admission, limited home health services if they are medically necessary, ordered by a physician, and intermittent, and hospice care when appropriate.

What Medicare does not cover is often the part families need most, ongoing help with daily living, supervision due to dementia, medication reminders, cooking, errands, or companionship.

That gap between medical care and daily life is where families and friends become overwhelmed.

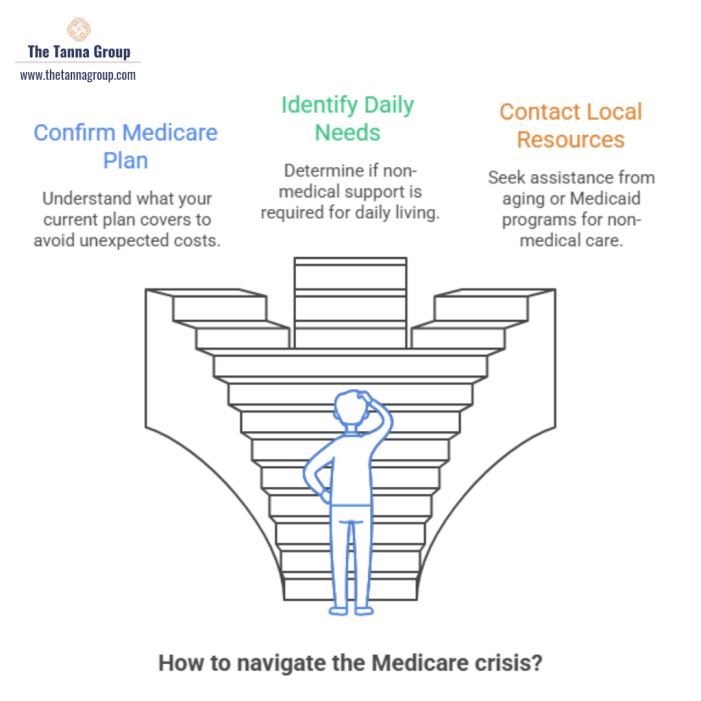

In situations like this, the most important step is not guessing or trying to piece things together alone. It is connecting with local aging and benefits resources that know how to assess eligibility and coordinate support.

In Texas, Texas Health and Human Services plays a critical role. They can evaluate eligibility for Medicaid, Medicare Savings Programs, and long term care waivers that may help cover in home support or placement for those who qualify.

Area Agencies on Aging, through Health and Human Services, is another key resource. They help evaluate needs, connect individuals to caregiver support, in home services, benefits counseling, and Medicaid related programs. They also coordinate the Medicare SHIP program, which provides free, unbiased help reviewing Medicare coverage without selling anything.

These agencies exist because what families do in the early days, out of love and urgency, is rarely sustainable without help.

Another important piece that often gets overlooked is what kind of Medicare plan the person is actually on. Whether someone has Original Medicare, a Medicare Advantage plan, or supplemental coverage can significantly affect what services are available, how care is coordinated, and where families may run into limitations. Knowing the type of plan matters just as much as knowing that someone has Medicare in the first place. That boundary exists to protect people, especially in vulnerable moments.

What stood out to me most in this situation was not confusion. It was compassion. A group of people doing everything they could, while quietly realizing they needed a plan that could last longer than goodwill alone.

Medicare is an important piece of the puzzle. But it is rarely the whole picture.

If you find yourself helping a friend, a neighbor, or a family member through something like this, know that feeling lost does not mean you are doing it wrong; it means you are seeing the full reality of what care requires. Also, it can help to pause and focus on just the next right steps.

By Niki Trentacosta. Niki Trentacosta works with individuals and families navigating Medicare decisions and life transitions. She believes clarity and compassion matter most when things feel uncertain.

By Niki Trentacosta. Niki Trentacosta works with individuals and families navigating Medicare decisions and life transitions. She believes clarity and compassion matter most when things feel uncertain.